Irs Capitalization Threshold 2025 - Irs Capitalization Threshold 2025. For tax years beginning in 2025, small businesses are not subject to the uniform capitalization rules if the average annual gross receipts are $27 million or less for the 3 preceding tax years and the business isn't a tax shelter. Effective for taxable years beginning on or after january 1, 2025, the irs has increased the de minimis safe harbor threshold from $500 to $2,500 per invoice or. IRS Announces 2023 HSA Limits Blog Benefits, For tax years beginning in 2025, small businesses are not subject to the uniform capitalization rules if the average annual gross receipts are $27 million or less for the 3 preceding tax years and the business isn't a tax shelter. Allowable contributions to hsas will rise by more than 7% in 2025.

Irs Capitalization Threshold 2025. For tax years beginning in 2025, small businesses are not subject to the uniform capitalization rules if the average annual gross receipts are $27 million or less for the 3 preceding tax years and the business isn't a tax shelter. Effective for taxable years beginning on or after january 1, 2025, the irs has increased the de minimis safe harbor threshold from $500 to $2,500 per invoice or.

IRS Expense vs Capitalization Rules Explained YouTube, For tax years beginning in 2025, small businesses are not subject to the uniform capitalization rules if the average annual gross receipts are $27 million or less for the 3 preceding tax years and the business isn't a tax shelter. Specifically, the gasb issued implementation guide no.

However, that understanding looks to be changing starting in fiscal years beginning after june 15, 2023 (fiscal year 2025). Specifically, the gasb issued implementation guide no.

Citizens and permanent residents who work in the united states need to file a.

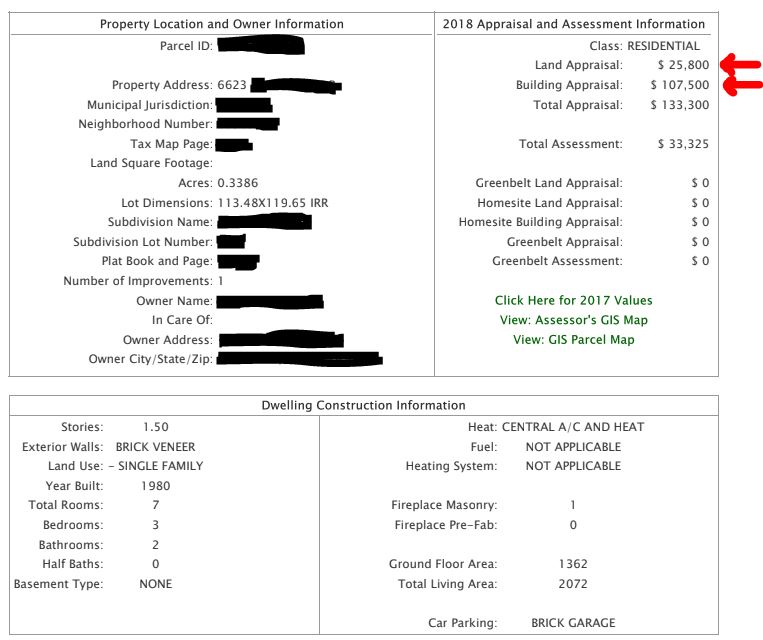

The 2025 Ultimate Guide to IRS Schedule E for Real Estate Investors, Taxable income how to file your taxes: So if the asset is valued:

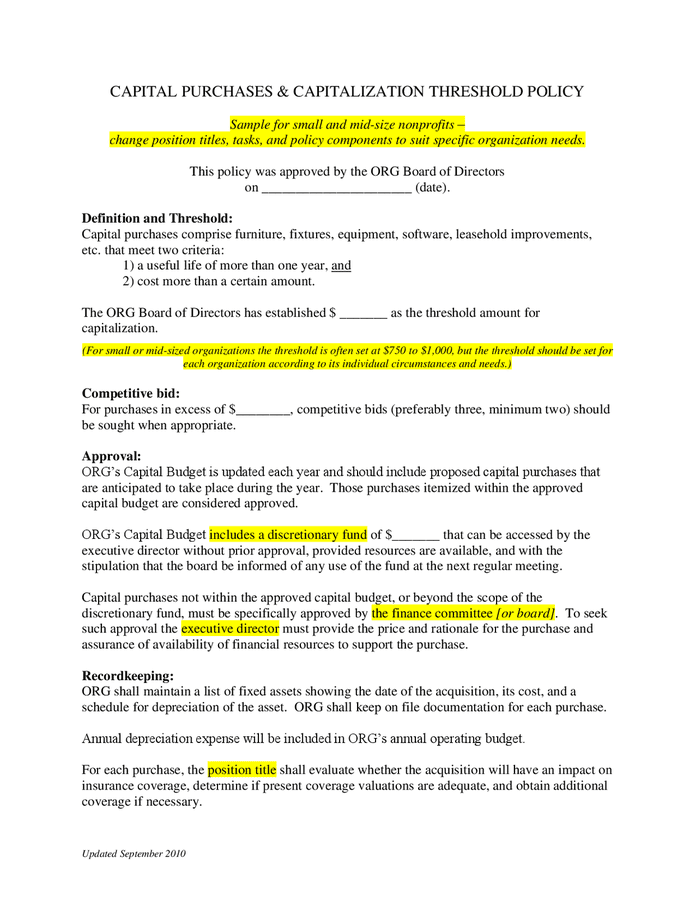

Example capitalization threshold policy in Word and Pdf formats, On december 12, 2025, the irs finally issued guidance for businesses to use the automatic accounting method change procedures to begin capitalizing and amortizing research. Taxable income how to file your taxes:

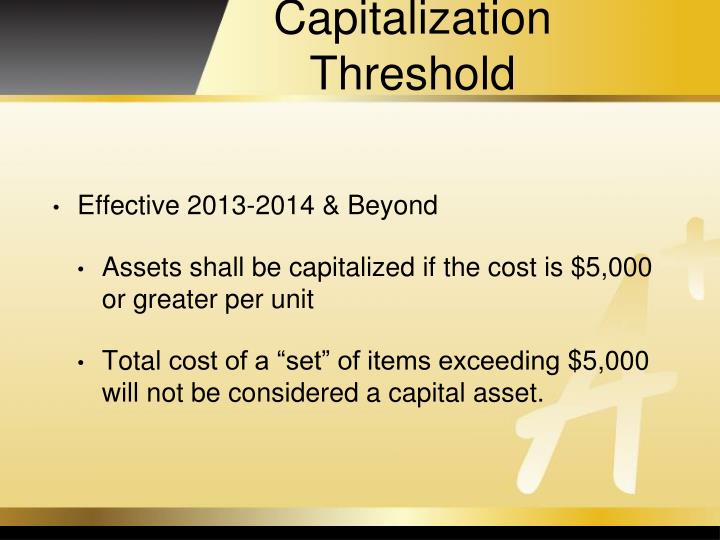

Social Security Wage Base 2025 [Updated for 2023] UZIO Inc, Consider adopting a capitalization threshold that coincides with the de minimis thresholds contained in the new regulations (i.e., $5,000 for organizations with an applicable. The internal revenue service (irs) has issued regulations that establish a de minimis safe harbor election that allows taxpayers who have a written capitalization.

Capitalization threshold processing, In early september, i published an article seeking guidance from the irs on how to implement the new capitalization rules under irc section 174, which was. Step by step irs provides tax inflation adjustments for tax year 2025 full.

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, So if the asset is valued: However, that understanding looks to be changing starting in fiscal years beginning after june 15, 2023 (fiscal year 2025).

Treasury, IRS Guidance for Farmers on Uniform Capitalization Rules, Page last reviewed or updated: The internal revenue service (irs) has issued regulations that establish a de minimis safe harbor election that allows taxpayers who have a written capitalization.

The internal revenue service (irs) has issued regulations that establish a de minimis safe harbor election that allows taxpayers who have a written capitalization.